Key Takeaways:

- At Growth Division, we follow the Bullseye Framework to help startups grow. This framework requires starting with between 3 and 6 marketing channels to test and validate.

- I review each of the 20 possible Bullseye channels when creating a marketing strategy for startup clients. I’ve outlined my process for this below, always keeping the ICP and business model front of mind.

- When narrowing down the shortlist, I think about how the channels will work together. That means considering how they grow and when they ‘peak’, balancing the funnel, and blending safer bets with bolder choices when I can.

- Book a strategy call with me if you’d like to work on this process for your startup together. For now, whether you’re setting the marketing strategy for your startup or are just interested in how Growth Division handles this stage, you’re in the right place.

As the cofounder of Growth Division, a growth marketing agency for startups, I read a lot of business books.

Most are good, plenty are forgettable, and a select few have actually changed the trajectory of my business or my life. Very rarely, a book has changed both.

Traction: How Any Startup Can Achieve Explosive Customer Growth by Gabriel Weinberg and Justin Mares is one of those books.

I first read Traction when my co-founder and I were growing our first startup.

We were right down there in the growth trenches, throwing spaghetti at the wall to see what worked; a few strands clung on, but most fell straight to the floor.

Then, we discovered the Bullseye Framework

Traction introduced us to the Bullseye Framework, a systematic process for testing and validating marketing channels by focusing on just 3 to 6 at once, bringing in channel experts to execute, and testing rigorously.

We were sold. We narrowed down our channel selection and, as soon as we landed enough investment, we brought in freelance channel managers to operate them.

It changed the trajectory of our startup; we were still creative and experimental, but now there was a structure and process. Sure enough, the numbers followed.

When we later sold our startup and started Growth Division, this framework became the basis for how we assembled teams and worked with our startup clients – and it remains that way today.

Now, we’ve successfully used this approach to grow over 130+ awesome startups, and I’ve been through the research process and written proposals for many more.

So whether you’re currently grappling with the channel selection for your own startup, or you’re just curious to understand what goes into a Growth Division proposal, you’re in the right place: I’m going to walk through how I approach this step by step.

Get in touch for a free Bullseye workshop with me. I’ll help you set objectives, plan your budget and then build a suitable channel mix. Book a Strategy Call.

Step 1: Laying the groundwork

By the time I sit down to assemble a channel strategy for a startup, I have already had at least two calls with its founder or head of marketing.

Over the course of those calls, we’ve established some key facts about their business, including:

- Growth objectives

- North Star Metric

- Customer personas

- Commercial model

- Unit economics (LTV & CAC)

- Budget

- Key competitors

- Current martech stack

- The typical customer journey

Of course, it’s normal for some parts to be in flux. What I’m really looking for here is evidence of a product-market fit, which lets me know this is the right time to step in and support with marketing.

We also spend some time digging into what they’ve already tried, and how this has worked out:

- What channels have they tested?

- How effectively were the channels run?

- What was the result?

After hashing out these details over the course of an hour and a half, I have a pretty good base with which to go away and do some additional research, and build a proposed channel mix.

Step 2: Channel-specific research

My next step is to carry out some channel-specific research, all with the context of this startup and its goals in mind.

Here’s an overview of the questions I’m asking of each channel during this process, and the tools I use:

💡 Top tip: Running each channel through the ICE framework (scoring each for Impact, Confidence and Ease) is a good way to build a shortlist ahead of the next stage. Remember that Ease is all about the use of resources, so cost should be factored into the Ease score.

(For a recap on what each channel covers, and great examples of each in action, head to my post explaining the Bulleye Framework in more detail.)

Marketing channel

How I evaluate this channel

Search Engine Marketing (SEM)

- How competitive are the relevant terms?

- Is the monthly search volume significant?

- Does the cost of acquisition look reasonable given our pricing structure?

- Do I see potential for our client here?

- Are competitors running ads?

💡 I also Google these terms myself and take a sweep of how the results look, and what competitors are doing.

🔧 Key tools: Google Adwords Planner

Social & Display Ads

- Are our competitors running social ads?

- If they are, what style of ads are they trying, and how can we do this differently?

- Can the ICP be influenced on this channel?

💡 By the way, if our competitors are running paid ads, I generally consider this to be a good sign – more on this later.

🔧 Key tools: Meta Ads Library, LinkedIn Ads Library

Offline Ads

- Is our target audience localised or large enough to make this effective?

- Is there sufficient budget to experiment with this channel?

Search Engine Optimisation (SEO)

- Do our competitors have big content/SEO plays, and who dominates the share of voice?

- How does our domain authority and backlink profile look against key competitors?

- What is the overall keyword difficulty in our sector, and how high is the search volume?

- Do I see potential with long-tail, lower difficulty keywords?

🔧 Key tools: Ahrefs, SEMrush

Target Market Blogs (TMB)

- Are there enough external blogs related to our industry?

- Do they use affiliate links?

- Do we have any contacts in our network who can support with placement?

💡This channel has been a key driver of growth for Growth Division.

Content Marketing

- How does their current content strategy fit with their wider business strategy, and where are the key gaps?

- How could content support other channels for this startup?

💡 As an example, a B2B product with a long sales cycle should have a higher proportion of bottom-of-the-funnel content, like case studies and sales enablement.

Speaking Engagements

- Are there enough of these types of engagements (podcast appearances, etc) to make this a worthwhile, ongoing channel?

- Does our audience attend these events or listen to these podcasts?

🔧 Key tools: Podchaser (or similar) for analytics and demographics

Events

- What does the events calendar look like for this industry?

- Does the client have the capacity to run events at the moment?

- Is there enough resource to do them properly?

Trade Shows

- Which trade shows do our audience attend, and which are our competitors attending?

- Is the product and brand at a place where it will stand out in a crowded room?

- Are they in an industry where people value face-to-face?

Community Building

- How active are the senior team on LinkedIn?

- Do the team have authority in the space?

- How developed are the company's Instagram and Facebook profiles?

- Can organic community building complement our wider paid strategy?

- Does the ICP particularly value referral recommendations?

Affiliate Marketing

- Are there potential good affiliates and ambassadors in this market? (Well-aligned in values and audience, and not so big as to make them unattainable)

- Can the startup support a strong affiliate programme right now?

- Is there a large enough margin for a decent incentive for referrals?

Existing Platforms

- Are there platforms the ICP regularly hang around on?

- How strong are existing groups and communities for our ICP?

- How could we tap into these?

- Is there scope to create our own community?

🔧Key platforms to explore: Reddit, Discord, Slack communities

Engineering as Marketing

💡This one’s a bit more creative – it’s more a case of whether we have any good ideas of things to build for our audience (such as calculators).

If we want SEO to be a main channel of distribution, I can look at search volume for related terms. I can also use Ahrefs to look at which pages have the most backlinks for competitor or comparable websites.

Viral Marketing

- Is this a service or product that we can see people referring others for?

- Do we have any creative ideas on how to achieve this?

- Is there a way to build a network effect into the product?

- Is a referral scheme already in place?

Sales

- If this startup doesn’t have a sales team, would they benefit from one?

- Is this a product-led play or do we need a sales person involved?

💡This channel is only right for B2B businesses.

Business Development

- Do we have good ideas for potential partnerships, and is the client open to them?

- How could this partnership look, and how would it support other channels?

- Have they had any successful partnerships in the past?

Unconventional PR

💡This is another channel that relies on having a creative idea that we think is right for the audience, and the client being open to this.

Public Relations (PR)

- Does the startup have the budget to support this channel?

- Is there a requirement for more top-of-the-funnel awareness on a large scale?

- Are our audience interested in more traditional media outlets?

💡 PR is typically one of the most expensive channels to test, which is why ‘budget’ is such a key question.

Direct Outreach

- For B2B startups: What direct outreach have they tried so far, and how could we approach this differently? Are the ICPs clear enough?

- For B2C startups: Would direct outreach be useful for finding partnerships, building relationships with influential people in the space or supporting PR activity?

Customer Engagement (AARRR)

- After reviewing everything that happens after I sign up for the product/service or join the mailing list, do I see room for improvement?

Step 3: Finding the perfect blend

The next part is where it’s going to get tricky: you need to narrow down your shortlist to between 3 and 6 channels to test and validate.

For me, this step is all about considering how potential channels would work together and strengthen each other.

Here’s how I approach finding that channel blend:

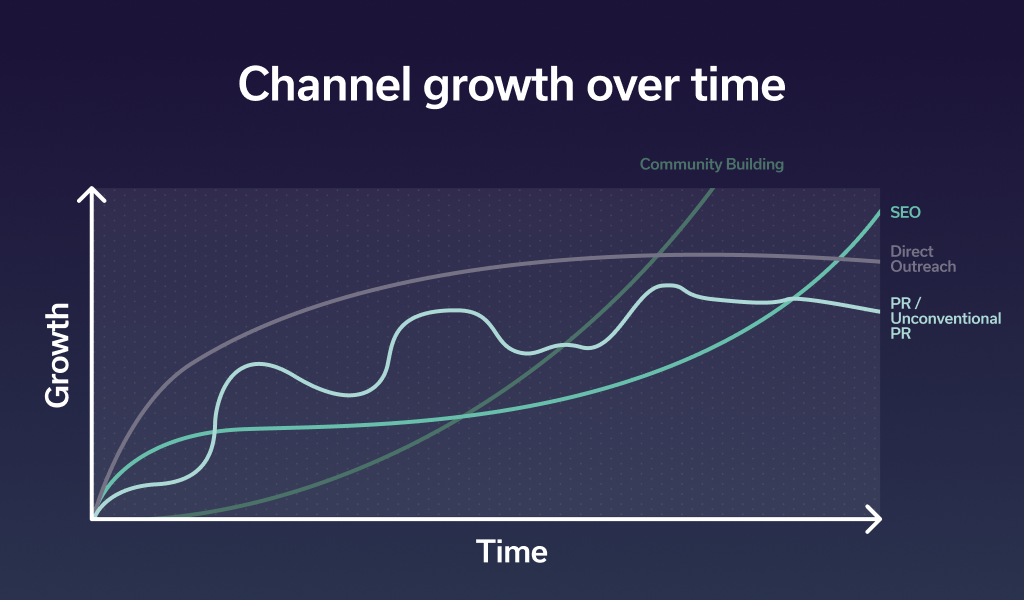

I think about how these channels typically grow over time

Even when they’re successful, each of these channels is going to have an impact on a different timeline – particularly when you’re starting from scratch.

SEO is a long-term game. There might be some quick wins, but the growth is likely to look like a hockey stick. PR and unconventional PR will show steep growth spikes around successful activity. Direct outreach – one of our most successful channels – typically starts adding value very quickly, but might start to level out over the long term.

The key word is ‘sustainable’. It’s relatively easy to move the needle quickly – but sustainable, affordable growth with a defensible cost per acquisition (CPA) is a harder balance to strike. Ultimately, I’m looking to balance quick wins with longer-term plays.

Case study: Eat Sleep Cycle

Eat Sleep Cycle came to us with flatlining growth. They were looking for a true long-term growth partner, which is always music to our ears.

🎯I assembled a team that blended long-term vision (SEO and Community Building) with faster-acting channels (Paid Ads and Email Marketing).

✅ Within 6 months of starting work together, we’d added €1 million in sales, and had increased their monthly revenue by 4x compared to the same month the year before. Best of all – we’re still working together, and still helping them grow. I even popped out to their Girona hub earlier this year!

“The best thing about working with Growth Division is guaranteed results each month, they just keep delivering. So I highly recommend working with them”

– Lee Comerford, Co-founder of Eat Sleep Cycle

I look at where each channel sits on the funnel

Similarly, I think about where each of the possible channels sits on the funnel, and how this aligns with the customer journey for this startup – and what they need right now.

This is not new thinking, but it is worth repeating here. Going ‘viral’ feels good – but don’t be distracted by shiny channels that don’t align with your business model.

💡Top tip: Some channels, like Content Marketing, can sit across any stage of the funnel, so the context of how I plan to use them is important here.

Case study: LUX Rewards

We helped LUX pivot towards enterprise clients, securing the first deal for 20m cards linked and £2.5m in revenue.

🎯Our ICP was a small pool of enterprise customers who required a hyper-targeted ABM campaign.

✅ Our use of Direct Outreach unlocked 5 initial meetings, and gave LUX an ROI of 50,000%.

“Thanks to Growth Division, we secured a major high-street bank in the UK and generated £2.5 million in revenue, exceeding initial expectations. The team was highly engaged and responsive throughout the engagement. Their reliability and support were key elements of their work.”

– James Courtney, CEO & Founder of LUX Rewards

I consider how the channels feed into each other

The Bullseye Framework is a bit like the colour wheel: some channels just complement each other perfectly.

This is a highly effective combo that we often reach for.

- Our Community Building channel expert works with the startup’s founder to start sharing posts from their profile, and to optimise it. They do the same for the company page.

- Our Social Ads channel expert can see which posts are gaining most traction across both the company profile and the personal one, and use this to inform the paid strategy.

- Meanwhile, our Direct Outreach channel expert is reaching out to prospects or worthwhile connections from the founder’s LinkedIn profile. These prospects head to the founder’s profile and find an active and interesting presence, rather than a half-baked one.

This is another well-established trio of channels.

- Good content is an essential component of SEO growth. So our SEO channel expert might work with our Content Marketing channel expert to make sure a certain number of pieces per month support their strategy.

- PR – as well as driving referral traffic and boosting trust – adds valuable backlinks to your website, which raises your domain authority, and gives more clout to any SEO work you’re doing. It’s a big tick in the ‘off-page’ SEO box – one of the 3 main components of SEO.

Get in touch for a free Bullseye workshop with me. I’ll help you set objectives, plan your budget and then build a suitable channel mix. Book a Strategy Call.

Case study: Retain

Retain International is a resource management platform used by some of the world’s leading brands. In August 2023, they came to us for help taking their growth marketing to the next level.

🎯 I assembled a classic channel mix for Retain, including the powerful trio of Social Display Ads (on LinkedIn), Community Building, and Direct Outreach.

✅ In our first 6 months of working together, we generated 150+ MQLs, and secured an enterprise deal which alone generated 193% ROI on total marketing spend. We’re still working together today, over two years later.

“Their constant transparency, friendly demeanour, responsiveness, and goal-oriented approach erase any notion of them being an external agency. It’s evident that they genuinely prioritise our success.“

– Rahat Ahmed, Marketing Manager at Retain

I mix confident choices with bolder ones

When I’m evaluating each of our 20 channels in the context of a potential startup client, competitor analysis is a key part of the puzzle.

For paid channels in particular, I generally believe that seeing your competitors using a channel is a positive sign. Obviously, it can drive up the price of keywords, and it means you need to do more to stand out, but it’s a soft signal that the channel is workable.

But for other, more left-field channels, it’s much more exciting to not see competitors in the space. I’m talking Events, Unconventional PR, Existing Platforms – the more creative options.

If the client is open to it, and it’s right for the business model, I like to leave some space for a curveball option alongside the safer bets.

Case study: Presca

Presca is a club for eco-conscious athletes who like to push themselves. After some success creating custom teamwear, they came to Growth Division for help pivoting into the B2C market.

🎯 We worked on longer-term brand-building efforts with Presca, and were unable to lock some fairly quick wins with a comprehensive SEO audit and overhaul. My favourite part of the project, though, was the Strava group we created, which initiated rapid word of mouth.

✅ With our combination of channels, we were able to grow their email list by 500, and rank for 57 additional keywords within 3 months.

“The Growth Division team met and exceeded all of the agreed-upon KPIs throughout the project. These included SEO improvement, traffic volume, and community growth. The company’s audience is deeply engaged with the platform and automated systems.”

– Guy Whitby, Co-founder of Presca

Now we have our channels – and it’s time to test and validate them

At this point, I have a shortlist of 3-6 channels to take forward. And once they’re signed off with the client, we get to work.

I may have chosen the channel mix for over 200 startups, but I can never promise that any one channel will work. At this stage of the process, every channel – and every channel activity – carries a hypothesis, and our job is to test this hypothesis with efficient growth experimentation.

The data is all that matters. And once we have spent enough time (typically 3-6 months) testing each of these initial channels, we have enough data to validate or invalidate them.

At this point, we double down on validated channels, remove the channels that aren’t working, and consider adding more into the mix.

I’ll break down exactly how we decide which channels to keep and which to cut, and how the next stage works, in a future post! For now, you can see a top-level overview of our end-to-end growth process.

📕 Up next: 101 Lessons from Scaling 101 Startups

Trusted by over 130 startups because our unique growth process and team of marketing experts unlock exponential growth